Commitment Savings Accounts Help Farmers Invest in Their Crops

Organization : B-Hub Editorial Team

Project Overview

Project Summary

Researchers offered savings accounts to smallholder cash crop farmers in rural Malawi. One type of account featured a commitment device that allowed the owner to restrict access to their own funds until a future date of their choosing.

Impact

Farmers offered commitment accounts accumulated more savings, increased their crop inputs and outputs, and benefited from $133.88 more in farm profits than those not given savings account assistance.

Cost

Maintaining a commitment savings account for one season costs the bank $23.34 per customer and costs the customer $11.30.

Challenge

Many people in developing nations have limited access to formal savings mechanisms, impeding their ability to save money and invest in agricultural inputs like tools and fertilizer that might help improve their crops. Among the many structural reasons for low savings rates (inaccessible banks, high transaction costs, distrust of financial institutions, lack of financial literacy), psychological barriers such as impatience or lack of self-control may also play a role. Additionally, people in rural areas might avoid accumulating assets because of an obligation to share any savings with their social networks.

Design

Tobacco farmers in Malawi were offered two types of savings accounts. The first “ordinary savings” group was given help opening an account with a 2.5 percent interest rate and setting up direct deposit for proceeds from their crop harvest. The other “commitment” group was offered the same savings account, with an additional option to open a special account that allowed them to “freeze” a specified amount of money until a certain date, usually right before the next planting season to preserve funds for farm input purchases.

Impact

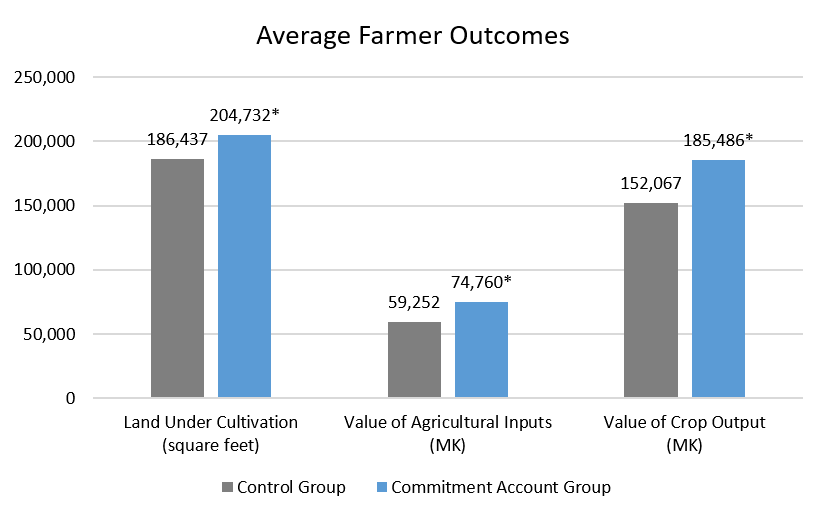

A randomized control trial with 3,150 farmers found that offering the commitment account option was associated with a 9.8% increase in land under cultivation, a 26.2% increase in agricultural input use, and a 22% increase in crop output in the subsequent harvest over the control group mean. The “ordinary savings” account did not have statistically significant effects.

* Significantly different from control group (p<0.05)

Among farmers who were offered both types of accounts, 89% of funds were put in ordinary savings accounts. The fact that most funds were not in a restricted account suggests that results from the commitment accounts were rooted in how they helped individuals protect funds from social network pressures (by providing a plausible explanation for why funds were unavailable for sharing), rather than in how they helped solve “self-control” problems.

Implementation Guidelines

Inspired to implement this design in your own work? Here are some things to think about before you get started:

- Are the behavioral drivers to the problem you are trying to solve similar to the ones described in the challenge section of this project?

- Is it feasible to adapt the design to address your problem?

- Could there be structural barriers at play that might keep the design from having the desired effect?

- Finally, we encourage you to make sure you monitor, test and take steps to iterate on designs often when either adapting them to a new context or scaling up to make sure they’re effective.

Additionally, consider the following insights from the design’s researchers:

- 60% of farmers with commitment accounts chose release dates immediately prior to the start of the planting season, which is when most input purchases occur.

- Study participants had low levels of financial literacy at a baseline assessment. To isolate the effects of the financial products, both the treatment and control groups were given a financial education session that reviewed basic elements of budgeting and explained the benefits of formal savings accounts.

- To test the assumption that farmers avoid saving because of a social pressure to share with others, researchers randomly assigned participants into two raffles to win a bicycle. The number of tickets each participant received was determined by his savings balance; one ticket for every 1,000 MK (~$1.38) saved. One raffle awarded tickets publicly; everyone could know how much their peers had saved based on the number of tickets received. The other raffle distributed tickets in private. The results of the experiment were inconclusive.

- To raise utilization in agriculture, many developing country governments and donors have implemented large-scale input subsidies, which can be expensive and unsustainable, or micro-credit programs, which tend to have much lower take-up rates than savings programs. For these reasons, formal savings programs have generated new interest. In this study, 19% of those offered any savings product opened accounts and made direct deposits.

Project Credits

Researchers:

Lasse Brune University of Michigan

Xavier Giné World Bank

Jessica Goldberg University of Michigan

Dean Yang University of Michigan