Information Disclosure Reduces Payday Loan Borrowing

Organization : B-Hub Editorial Team

Project Overview

Project Summary

To help payday loan borrowers lower their use of high-cost debt, researchers printed the high annual percentage rates, the adding-up of dollar fees, and the typical repayment profile of payday borrowers on the cash envelope.

Impact

The dollar information reduced likelihood of borrowing in a later pay cycle by 11%, compared to those who did not receive the extra information. All three types of information disclosure reduced amounts borrowed in post-intervention pay cycles, by $28 to $55.

Challenge

Low-income households often rely on non-mainstream financial products for access to credit. Payday loans, in which a borrower receives cash in advance and the lender receives a fixed fee of US$15 or US$17 for every US$100 on the next paycheck date, are one popular option in the United States. However, the fixed fee is extremely costly, with implied APRs (annual percentage rates) well over 400%. It was estimated that in 2007, Americans paid $8 billion in financial charges to borrow $50 billion from payday lenders. Customer advocates argue that people who are financially illiterate or unsophisticated are driven by lenders into debt traps.

Design

At payday lenders, the customer service representative usually puts the cash and a copy of the loan paperwork inside a standard size (4 x 9 inch) company envelope, and writes the payment due date and amount due on the calendar printed on the outside. This intervention replaces the usual cash envelopes with custom envelopes printed with one of three different pieces of information:

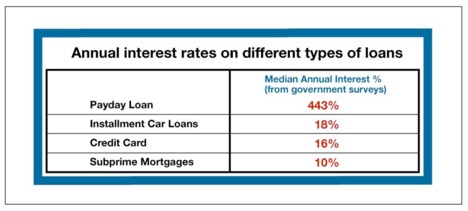

- APR information: the typical payday lending interest rate (443%), compared to interest rates of a credit card (16%), an installment car loan (18%) and a subprime mortgage (10%).

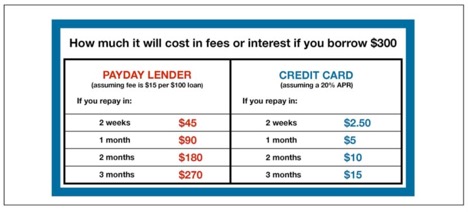

- Dollar information: the dollar costs for borrowing $300 for 2 weeks, 1 month, 2 months, or 3 months on payday loan compared to a credit card.

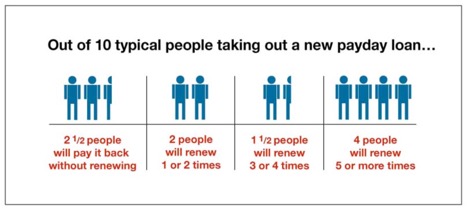

- Refinancing information: a graphic showing how many times a typical payday borrower refinances a loan before paying it back.

Standard Envelope

APR Information

Dollar Information

Refinancing Information

In addition, a self-control tool – a savings planner with tips on how to reduce expenditure – was inserted into some of the cash envelopes.

The intervention involved all the customers entering 77 stores of the payday lender, spanning 10 states, over a period of 2 weeks. Customers were randomly assigned to receive either one of the three intervention envelopes, or the standard cash envelope. Their borrowing behavior was followed during post-intervention pay cycles over a period of about 4 months.

Impact

A randomized evaluation showed that envelopes printed with dollar costs over time reduced borrowing from the payday lender in later pay cycles by about 11%. The other information types did not significantly reduce the likelihood of borrowing in a post-intervention pay cycle.

All intervention treatments produced meaningful reductions in amount borrowed during post-intervention pay cycles. Individuals who received the dollar information borrowed $55 less, those who received the APR information borrowed $38 less, and those who received the refinancing information borrowed $28 less in each pay cycle compared to those receiving the standard cash envelope.

There is no evidence that the savings planner independently reduced payday borrowing, or worked in combination to reinforce the effectiveness of other information disclosures.

Implementation Guidelines

Inspired to implement this design in your own work? Here are some things to think about before you get started:

- Are the behavioral drivers to the problem you are trying to solve similar to the ones described in the challenge section of this project?

- Is it feasible to adapt the design to address your problem?

- Could there be structural barriers at play that might keep the design from having the desired effect?

- Finally, we encourage you to make sure you monitor, test and take steps to iterate on designs often when either adapting them to a new context or scaling up to make sure they’re effective.

Additionally, consider the following insights from the design’s researchers:

- It may take at least one pay cycle for information treatments to have their full effect as people accumulate funds to pay off their debt.

- While this evaluation showed consistent reductions in borrowing over a couple months’ post-intervention, borrowers were not followed for longer to test how long the effects of the information disclosure on borrowing behavior would last.

- By surveying participants, researchers observed that the dollar information treatment was most effective at reducing borrowing among less educated borrowers and those who scored highly on a self-control scale, while the APR information was more effective among those who scored lower on the self-control scale.

Project Credits

Researchers:

Marianne Bertrand University of Chicago, Booth School of Business

Adair Morse University of Chicago, Booth School of Business