Promoting Retirement Savings with Social Media

Organization : RCMAR-CHIME

Project Overview

Project Summary

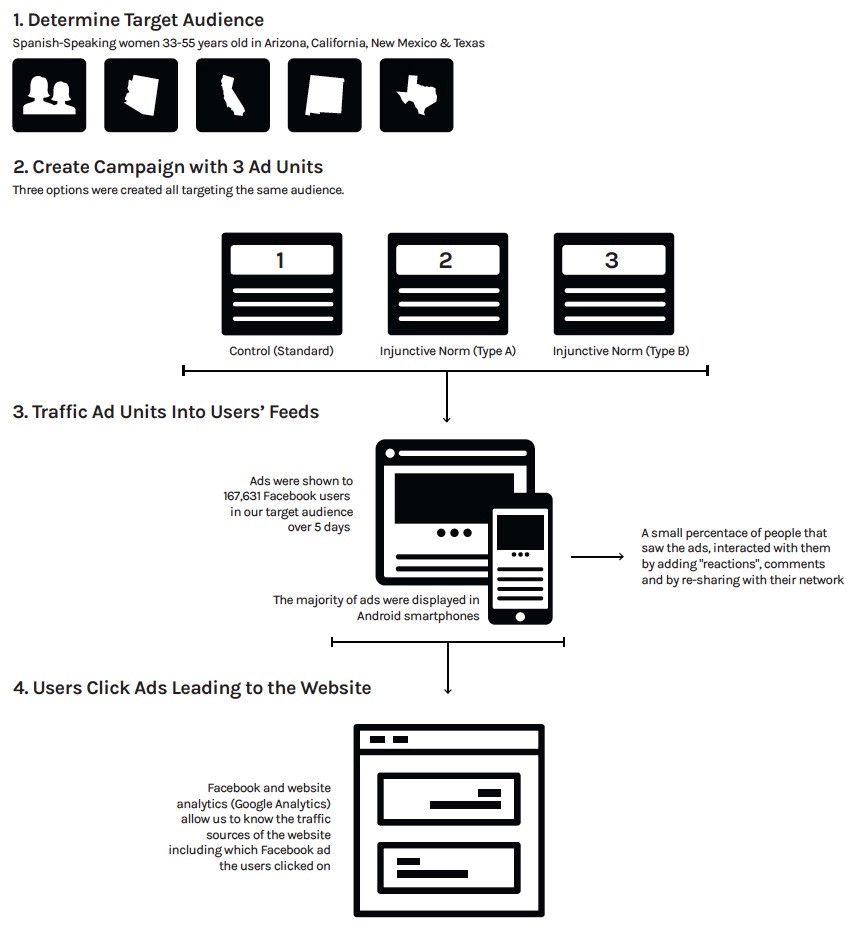

Different messages centered on financial planning for retirement were shown via the Facebook advertisement platform to Hispanic women ages 33-55 in four states (AZ, CA, NM, and TX) to determine whether a message centered on family or peer norms is more effective at interesting them to learn about retirement.

Impact

We found that a message centered on peer influence was more effective than a message centered on family in getting Hispanic women interested to learn about financial planning for retirement.

Cost

$3000 in Facebook advertising ($0.32-$0.47 average cost per impression)

Challenge

The lack of financial planning and saving for retirement is an important policy issue in the United States, where there are significant differences among racial and ethnic groups in retirement preparedness. According to the Federal Reserve, in 2015, while only 26% of working-age white households did not have retirement savings, 40% of blacks and 43% of Hispanics lacked any retirement savings.

Women fare worse when it comes to retirement preparedness, especially Hispanic women. Data from Vanguard DC retirement accounts show that the median value accumulated in retirement accounts for women in 2014 was $24,446, or just 66% of the $36,875 median retirement savings of men. A survey of 25,435 adults in 2015 found that 34% of all females aged 35 years and older feel financially secure, but only 27% of Hispanic females feel financially secure.

Because Hispanic women have lower levels of wealth accumulation and retirement preparedness, they are likely to face significant challenges as they age. Therefore, improving Hispanic women’s asset building and preparedness for retirement requires not only studying the barriers they face when planning and saving, but also studying the best way to provide them with information about financial planning for retirement.

Design

We conducted our experiment twice; the first round took place during July 21– 25, 2016, and the second round during April 22–25, 2018. Both experiments were almost identical, with only a small variation in the message of the type B ad. The three ads were as follows:

1) Control (standard): “Start to prepare for retirement today” (Empieza a prepararte para tu retiro hoy).

2) Injunctive Norm Type A (peer effect): “Many Hispanic women like you already have a plan for retirement” (Muchas mujeres hispanas como tu ya tienen un plan para el retiro).

3) Injunctive Norm Type B (family centered): “Having a plan for retirement protects me and my family” (Tener un plan del retiro me protege a mi y a mi familia). To be consistent with the “you” voice, for the experiment we conducted in April 2018, we modified the message in Type B to the following: “Having a plan for retirement protects you and your family” (Tener un plan del retiro te protege a ti y a tu familia).

The messages were all in Spanish, to target Spanish-speaking women. Targeting Spanish-speaking Hispanic women is important since fewer online resources on retirement saving and planning are in Spanish, and lack of English proficiency appears to affect financial behavior. Nonetheless, when we ran our experiment on Facebook, we selected both English- and Spanish-speaking Hispanic women so that we could reach bilingual women with different levels of proficiency. The figure below presents our experiment at glance.

Facebook experiment at a glance

Impact

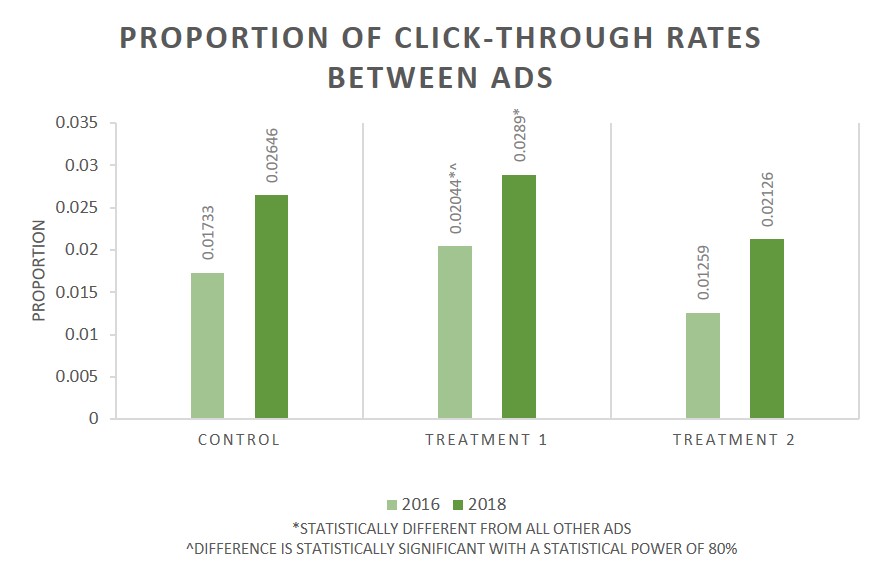

In both experiments, we found that an injunctive norm message centered on peer influence (Type A) was more successful than a standard message (control) and a message centered on family (Type B) in getting Hispanic women to learn more about financial planning for retirement. Comparing click-through rates among the different messages (i.e. the percentage of people visiting our web page from the ad), we observe that the type A message had a higher click through rate than the other messages in both experiments, and this difference was statistically significant.

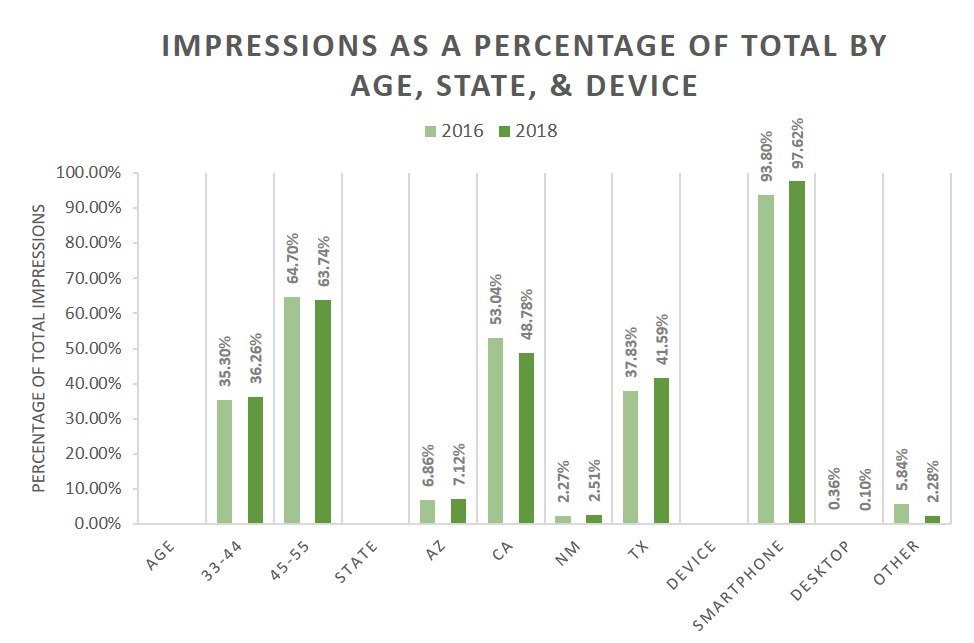

We also find that our ad campaigns were more successful among women aged 44–55 years in California and Texas. Knowing that there is an interest in retirement planning will be important in designing a program targeting women in this age range. Getting women to start saving for retirement in their 40s will allow them to build wealth for approximately 20–30 years – a significant amount of time.

The majority of individuals viewed the Facebook ad through a smartphone – specifically, an Android smartphone – and not a desktop computer. This population may be harder to reach through a desktop channel, which should be considered when designing future interventions to promote retirement planning among Hispanic women. An intervention that leverages this technology might be a simple and cost-effective way to promote better financial management practices among Hispanic women.

Implementation Guidelines

Inspired to implement this design in your own work? Here are some things to think about before you get started:

- Are the behavioral drivers to the problem you are trying to solve similar to the ones described in the challenge section of this project?

- Is it feasible to adapt the design to address your problem?

- Could there be structural barriers at play that might keep the design from having the desired effect?

- Finally, we encourage you to make sure you monitor, test and take steps to iterate on designs often when either adapting them to a new context or scaling up to make sure they’re effective.

Additionally, consider the following insights from the design’s researchers:

- We used the same picture in all ads to ensure consistency and the ability to detect differences in performance based on the content of the message alone.

- We used a generic message as our control message, and we explored two forms of injunctive norms. In Type A, our message, emphasizing peer influence as well as self-empowerment, suggests that having a plan for retirement is something desirable and attainable. In Treatment 2, our message, emphasizing the importance of familial relations, suggests that having a plan for retirement is something that should be done to protect one’s self and family.

- We constructed a mobile-friendly website for our experiments that provides concise information in Spanish about retirement planning and saving and other useful links: yoplaneomiretiro.com.

- We used Google Analytics to determine which ad brought visitors to our webpage. Through Facebook tools, we are also able to evaluate how our ads performed in different subsamples (impressions and link-clicks disaggregated by state, age and device) to learn more about our target population. To determine what message is more effective, we tested the significance of the difference between two independent proportions from the click-through metric.

- Learn more about A/B Testing, also known as Split Testing, on Facebook.

Project Credits

Researchers:

Luisa R. Blanco Pepperdine University

Luis M. Rodriguez Ogilvy