Can Rewards Improve Tax Compliance?

Organization : Inter-American Development Bank

Project Overview

Project Summary

In an effort to reward good taxpayers and improve compliance with property taxes, the Santa Fe municipal government in Argentina organized a lottery (called the “Good Taxpayer Award”) which entitled the winners to the construction or renovation of a complete sidewalk.

Impact

Winning the lottery and being publicly recognized by the government has a positive but not persistent effect on future tax compliance, while receiving the sidewalk reward has a large positive and persistent effect. Large and persistent spillover effects exist: neighbors of those who receive the reward comply more too, and these effects can be even larger than the direct effects.

Cost

The city estimated that the average sidewalk renovation would cost ARG $5,250 (approx. USD $1,553). This is equivalent to 14.4 times the average yearly tax payment (ARG $363.5) in 2008 and 9.7 times the average yearly tax payment of 2009 (ARG $539.5).

Challenge

As rewards increasingly become an instrument used by policymakers, it is important to find a reward mechanism that does not crowd out intrinsic motivation, is long lasting, and has positive spillover effects on third parties. A policy innovation introduced by the Municipality of Santa Fe (Argentina) allowed us to evaluate different mechanisms for rewarding tax compliance – participation in a lottery (financial motive), public recognition (moral channel), and provision of a visible and durable good (reciprocity and peer effect channels).

Design

In an effort to reward good taxpayers and improve property tax compliance, the municipal government of Santa Fe in January 2009 organized a lottery that entitled winners to the full construction or renovation of the sidewalk in front of their homes. The city announced a lottery for those with no pending tax arrears at a certain future date. After the due date, the city government randomly selected 400 individuals among more than 72,000 taxpayers who had complied with the payment of their property tax. Lottery winners were announced in local newspapers, and these individuals were awarded the construction of a sidewalk, when possible (see referenced paper for elaboration on this issue).

Impact

Results indicate that rewarding taxpayers for good behavior has large positive and persistent effects for lottery winners and for the neighbors of winners.

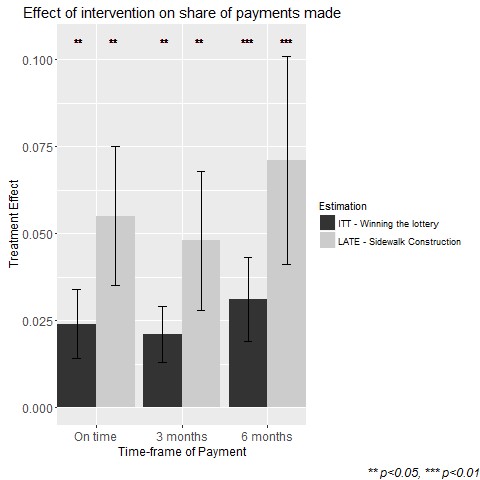

The lottery increased the likelihood that winners pay their tax obligations on time by about 3.1 percentage points (not the instantaneous effect but the average over the period), and it raised the probability that property taxes were paid within 3 (6) months by 2.4 (2.1) percentage points (see ITT columns in graph below). Lottery winners were also 3 percentage points more likely to continue paying on time over the next few years compared to their peers. This effect is significant (p<0.05) and persistent for at least 3 years after the intervention. Not every lottery winner actually received the sidewalk construction prize (the referenced paper elaborates on this issue). In such cases, the effect of the lottery win and public recognition alone faded away after a few months. Actually completing sidewalk renovations increased timely payment rates by 7.1 percentage points (average effect for the whole period), and the likelihood that tax bills were paid within 3 and 6 months increased by 5.5 and 4.8 percentage points, respectively (see LATE columns in graph below), an effect which persisted over time.

High and persistent spillover effects from the winners to their neighbors were found. These effects are not universal but seem to depend on the salience of the reward. As an example, a homeowner who is the neighbor of a winner but did not participate in the lottery, who is living in an area of the city with low public service provision, is about 7.5 percentage points more likely to pay on time (p<0.05), about 10 (15) percentage points more likely to pay within 3 (6) months (p<0.01), and about 15 percentage points more likely to pay at all (p<0.0.1). These results are persistent in the long run. No significant financial motive effect was found, indicating that people do not pay their taxes just to participate in the lottery.

Implementation Guidelines

Inspired to implement this design in your own work? Here are some things to think about before you get started:

- Are the behavioral drivers to the problem you are trying to solve similar to the ones described in the challenge section of this project?

- Is it feasible to adapt the design to address your problem?

- Could there be structural barriers at play that might keep the design from having the desired effect?

- Finally, we encourage you to make sure you monitor, test and take steps to iterate on designs often when either adapting them to a new context or scaling up to make sure they’re effective.

Additionally, consider the following insights from the design’s researchers:

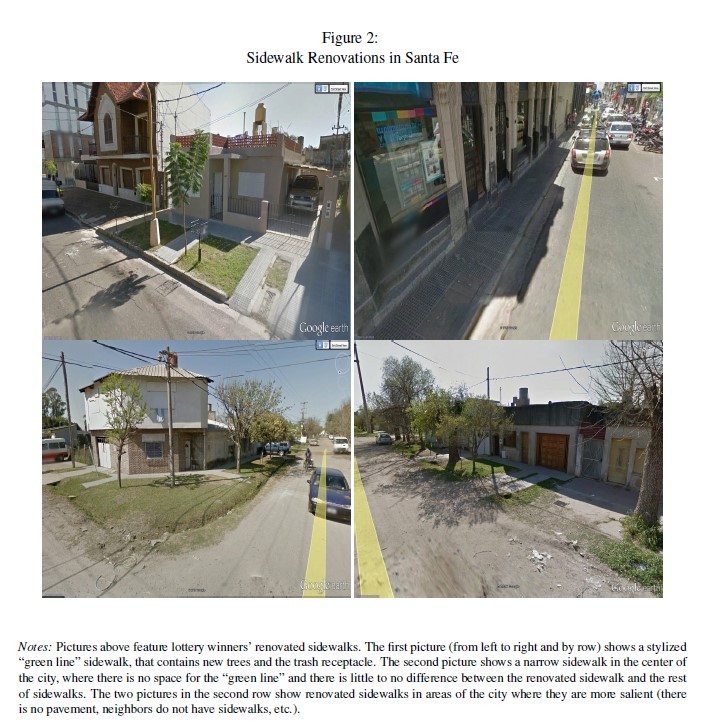

- The sidewalk renovations included the removal of the old sidewalk, sewerage adjustments, and convenient features such as a trash receptacle that would not be accessible to animals, as well as a section dedicated to plants and trees (also provided by the Municipality). The reward choice of a highly visible and durable good showing government use of public money in action was intended to enhance for the lottery winners, have spillover effects on their neighbors, and to generate a longer lasting effect than other reward strategies.

- The rules of the lottery were officially announced on December 16, 2008. Owners of residential units, commercial properties and / or vacant lots were eligible to participate in a lottery as long as they had paid their 2008 property tax liabilities before the January 12, 2009. Each eligible property received a unique number, and 400 properties were randomly chosen from a set of 72,742. The lottery took place on February 27, 2009. City officials contacted the winners and announced the results in local newspapers.

Project Credits

Researchers:

Paul E. Carillo George Washington University

Edgar Castro Inter-American Development Bank

Carlos Scartscini Inter-American Development Bank