Commit to Saving: Don’t Stop Until You Save Enough

Organization : Innovations for Poverty Action

Project Overview

Project Summary

Savings accounts that prevent clients from accessing their funds until they reach a goal can increase household savings and give women more influence over household finances.

Impact

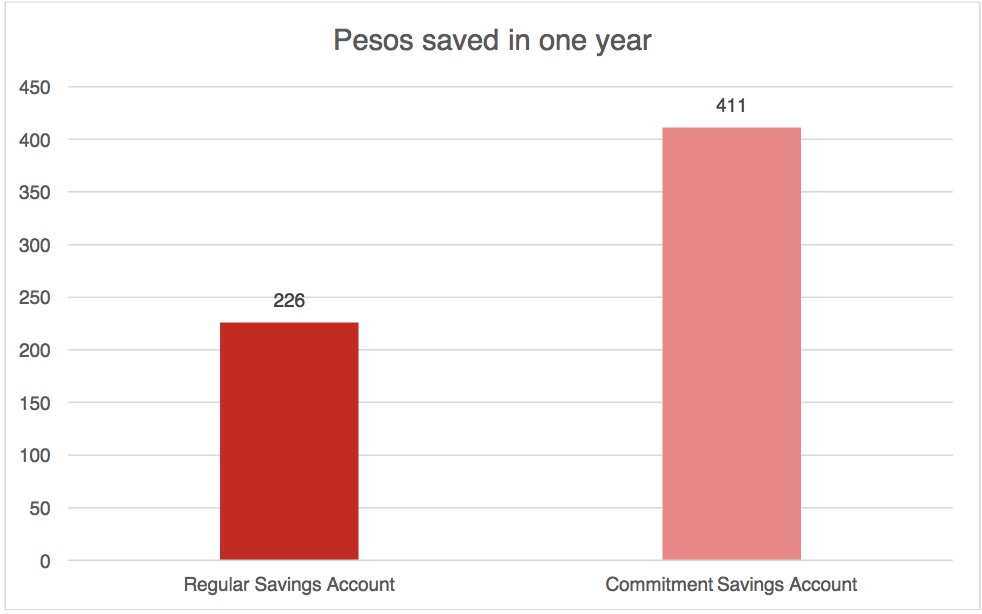

Clients who were offered commitment savings accounts saved an additional 411 pesos during the first year of the program, corresponding to an 82% increase in savings relative to clients who were not offered the chance to open the account.

Source

Source

Challenge

Saving money is difficult, especially when pressing needs make it very difficult to put off spending. Some people face additional pressure from family members over spending decisions; in particular, when women make less money than men, household resources are not allocated in a way that reflects women’s preferences. Researchers, policymakers, and banks are interested in ways to help people save more, allowing them to pay for unexpected expenses and costly investments.

Design

The Green Bank of Caraga, a small bank in Mindananao, Philippines, designed the SEED savings account (Save, Earn, Enjoy Deposits). The SEED account required that clients commit to avoid withdrawing funds from the account until they reach a goal date or amount, but did not explicitly commit the client to depositing funds after opening the account. Clients wrote their savings goal, which often included saving for celebrations or tuition expenses, on the form used to open the account, as well as on a “Commitment Savings Certificate” that was given to clients to keep.

The bank hired marketers to visit the homes and/or businesses of the clients. Marketers stressed the importance of savings, including discussing clients’ motivations for savings and emphasizing to the client that even small amounts of saving make a difference. They then explained the SEED product and offered clients the chance to open a SEED account.

Impact

A randomized evaluation found that clients who were offered commitment savings accounts saved an extra 235 pesos over the first six months of the program, and an extra 411 pesos during the first year. The long-term savings corresponds to an 81 percent increase in savings relative to clients who weren’t offered the SEED account. (On average, bank clients had between 500-530 pesos in their savings accounts before the program started.)

Additionally, married women offered the SEED account reported having significantly more decision-making power in their households. For women who had lower decision-making power before the start of the project, the number of “female-oriented” large purchases (washing machines, sewing machines, electric irons, kitchen appliances, etc.), as well as the total amount of money that their households spend on these items, increased as a result of being offered the SEED account.

What worked best:

- Simply educating clients on the importance of savings is not enough — offering the commitment savings account is crucial. Researchers also randomly assigned a proportion of Green Bank’s clients to receive visits from marketers in which the marketers covered all the same topics they did when explaining SEED—they stressed the importance of savings, discussed clients’ savings goals, etc.—but did not offer these clients the opportunity to open a commitment savings account. This marketing and education approach did not increase clients’ savings.

Implementation Guidelines

Inspired to implement this design in your own work? Here are some things to think about before you get started:

- Are the behavioral drivers to the problem you are trying to solve similar to the ones described in the challenge section of this project?

- Is it feasible to adapt the design to address your problem?

- Could there be structural barriers at play that might keep the design from having the desired effect?

- Finally, we encourage you to make sure you monitor, test and take steps to iterate on designs often when either adapting them to a new context or scaling up to make sure they’re effective.

Additionally, consider the following insights from the design’s researcher:

Description of the SEED (Save, Earn, Enjoy Deposits) savings product:

- The SEED account required that clients commit to not withdraw funds from the account until they reach a goal date or amount but did not explicitly commit the client to deposit funds after opening the account.

- The savings goal was written on the form used to open the account, as well as on a “Commitment Savings Certificate” that was given to the client to keep.

- An illustrative example from the original study: 48 percent of clients who made a savings goal reported wanting to save for a celebration, such as Christmas, birthday, or fiestas (large, local celebrations that happen at different dates during the year for each community). Twenty-one percent of clients chose to save for tuition and education expenses, while 20 percent of clients chose business and home investments as their specific goals.

- Other than providing a possible commitment savings device, no further benefit accrued to individuals with this account. The interest rate paid on the SEED account was identical the the interest paid on a normal savings account (4% per year).

The bank also offered each SEED client a locked box (called a “ganansiya” box) for a small fee in order to encourage deposits. This locked box was similar to a piggy bank: it had a small opening to deposit money and a lock to prevent the client from opening it. Only the bank, and not the client, had a key to open the lock. Thus, in order to make a deposit, clients needed to bring the box to the bank periodically. Of the 202 clients who opened SEED accounts, 167 opted for this box. The box would have been easy to break open, so it did not represent a hard physical barrier; rather, it was a mechanism.

Would this work elsewhere?

Banks all over the world have begun to offer commitment savings accounts, and most well-conducted studies demonstrate that (1) clients open these accounts when they are offered; and (2) commitment savings accounts help people save more money.[1] Researchers believe that these results are generalizable to other contexts where the same basic conditions apply: clients want to save money, but have a hard time doing so, and are willing to accept some consequences or restrictions to help them reach their savings goals.

Additional considerations that may affect whether commitment savings accounts are effective tools for increasing savings include:

- How severe to make the consequences or restrictions for clients (some research indicates that less severe restrictions can lead to increased savings[2]).

- Whether to combine offering commitment savings accounts with sending clients reminders to deposit in these accounts.

As with every intervention, effective implementation would be required for this approach to work elsewhere, and all interventions benefit from rigorous monitoring and evaluation.

Cost effectiveness

Costs you are likely to encounter include:

- Personnel time to design a commitment savings account

- Personnel time for training employees to offer, open, and administer the commitment savings accounts

- Materials costs for any marketing or educational materials you may want to provide clients about their new accounts

Project Credits

Page submitted by:

Innovations for Poverty Action More projects from this organizationResearchers:

Nava Ashraf Harvard Business School

Dean Karlan Yale University

Wesley Yin University of Chicago

[1] Brune, Lasse; Giné, Xavier; Goldberg, Jessica; Yang, Dean. 2011. “Commitments to Save: A Field Experiment in Rural Malawi.” Policy Research working paper; no. WPS 5748, Impact Evaluation series; no. IE 50. World Bank.

[2] Karlan, Dean, and Leigh L. Linden. Loose Knots: Strong versus Weak Commitments to Save for Education in Uganda. No. w19863. National Bureau of Economic Research, 2014.