Promoting Mobile Banking with Behaviorally Informed Text Messages

Organization : ideas42

Project Overview

Project Summary

In partnership with a mobile network operator and a microfinance institution, we tested behaviorally informed text messages with the goal of increasing adoption and use of a new digital savings and micro-loan product in Mali and Madagascar.

Impact

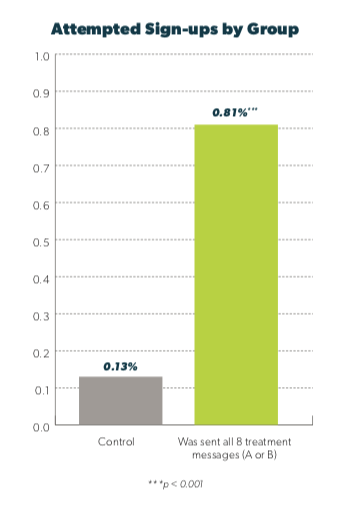

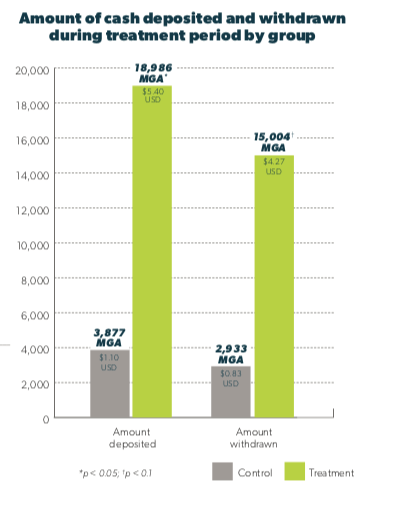

The behavioral text message campaign increased sign-up attempts for the new digital savings and loan product in Mali from 0.13% to 0.81%. In Madagascar, the behavioral text message campaign increased mobile money deposits and withdrawals by about five times.

Source

Source

Challenge

In Mali and Madagascar, where over half of the population lives below the poverty line and 90% are unbanked, achieving financial health is a significant challenge for most people. Digital financial services are a promising channel to increase financial inclusion and stability across developing countries by leapfrogging traditional banking channels. For example, the percentage of adults with a financial account more than doubled between 2014 and 2017 in several sub-Saharan African countries in large part due to the growth of digital financial services.

Design

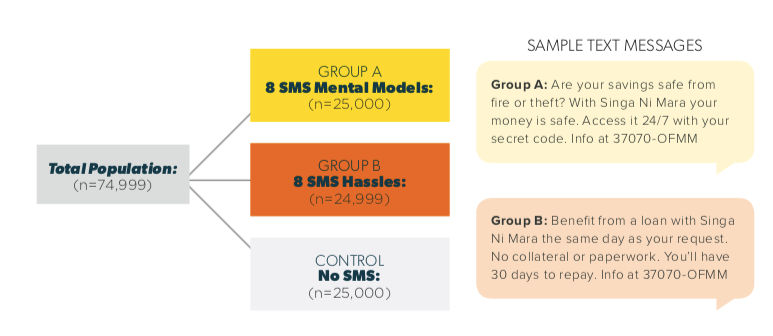

In Mali, we developed two versions of a series of eight behaviorally informed text messages in order to encourage clients of mobile money provider Orange Money living in Bamako to sign up for a new micro-loan product, Singa Ni Mara.

- Group A received a text message stream that focused on establishing an accurate mental model of the new Singa Ni Mara product. These messages aimed to address barriers such as an expectation that the product would be unreliable, concerns that the terms would be unfavorable, or uncertainty about the benefits compared to those of other financial management tools.

- Group B received a text message stream that focused on reducing perceived and experienced hassles to sign up for or use the product.

- To have a comparison point for the impact of our messages, we also measured outcomes for a control group, which did not receive any direct messaging about Singa Ni Mara.

Intervention design in Mali

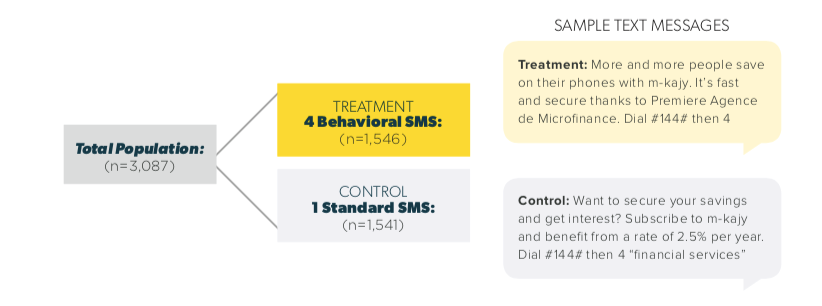

In Madagascar, we designed a series of four behaviorally informed text messages in order to encourage Orange Money clients to sign up for and save on a similar savings and microloan product, M-Kajy. Due to partner priorities, the pilot targeted clients who had been identified by the microfinance institution’s algorithm as having a short or unreliable payment history with Orange Money or lower transaction amounts and frequencies. As these lower engagement clients would not qualify for a loan on M-Kajy, the messages focused on the savings functionality.

- The campaign highlighted the benefits of saving on M-Kajy, the risks of non-digital and/or informal savings practices, the growing social norm of saving digitally, and the fact that with compound interest, small amounts of savings can grow large over time. We chose this messaging to address a variety of behavioral barriers. A better understanding of the benefits of a new product and the risks of alternative practices helps consumers make an informed choice about their financial practices and overcome the inertia of the status quo. Knowing that many other people are using a new product makes it more appealing and assuages fears of unreliability. And highlighting the compounding effect of interest over time can make even small deposits feel worthwhile.

- A control group received one single standard marketing message about M-Kajy.

Intervention design in Madagascar

Impact

In Mali, the randomized evaluation found that text messages significantly increased sign-up attempts from 0.13% in the control group to 0.81% in the treatment groups. However, total successful sign-ups in all groups remained very low, with only 204 people attempting to sign up during the pilot period (out of 74,999), of which 173 were accepted.

Results in Mali

In Madagascar, no client in either the treatment or control group signed up for M-Kajy. However, clients in the treatment group deposited significantly more money into their pre-existing Orange Money wallets (18,986 MGA or ~$5.40) than clients in the control group (3,877 MGA or ~$1.10), a nearly five-fold increase. Treatment clients also withdrew more money (15,004 MGA or ~$4.27) than clients in the control group (2,993 MGA or ~$0.83), again by about five times. Overall, these results represent a considerable increase in account activity for the treated clients, but savings outcomes are less clear. Though we see a larger positive net change in balance for treated clients than for control group, the difference was not significant.

Results in Madagascar

Implementation Guidelines

Inspired to implement this design in your own work? Here are some things to think about before you get started:

- Are the behavioral drivers to the problem you are trying to solve similar to the ones described in the challenge section of this project?

- Is it feasible to adapt the design to address your problem?

- Could there be structural barriers at play that might keep the design from having the desired effect?

- Finally, we encourage you to make sure you monitor, test and take steps to iterate on designs often when either adapting them to a new context or scaling up to make sure they’re effective.

Additionally, consider the following insights from the design’s researcher:

- It is worth considering whether text messages are an ideal channel for grabbing client attention given that Orange Money clients and mobile phone users across developing countries already receive many promotional text messages. Furthermore, we attempted to only send messages to clients who previously sent text messages or purchased internet packages to ensure that most recipients would be able to read them. However, it is also possible that some clients were unable to read or fully understand the text messages, as 67% of adults in Mali and 35% of adults in Madagascar are not literate.

- We recommend that future communications-based interventions targeting the adoption of a new digital financial product ensure that the operational structure is in place and has been user tested before launching, to enable successful take-up of the product. We also suggest that initial testing is done with a target population for whom the value proposition of the product is high. Digital campaigns can be improved via iterative, rapid A/B testing of messages leveraging pilot test results as well as qualitative interviews with pilot or target clients in order to optimize messaging that speaks to their preferences, needs, and concerns.

- Future interventions in Mali, Madagascar, or other low-literacy populations may want to consider expanding into higher-touch, more inclusive channels such as automated voice calls or agent-based interventions in order to ensure the messages are heard and understood.

Project Credits

Researchers:

Nicki Cohen ideas42

Tina Razafinimanana ideas42

Lois Aryee ideas42

Manasee Desai ideas42

Jiyoung Han ideas42

Julia Gray Aga Khan Development Network

Sitara Merchant Aga Khan Development Network