Improving Property Tax Compliance with a Reminder Letter

Organization : ideas42

Project Overview

Project Summary

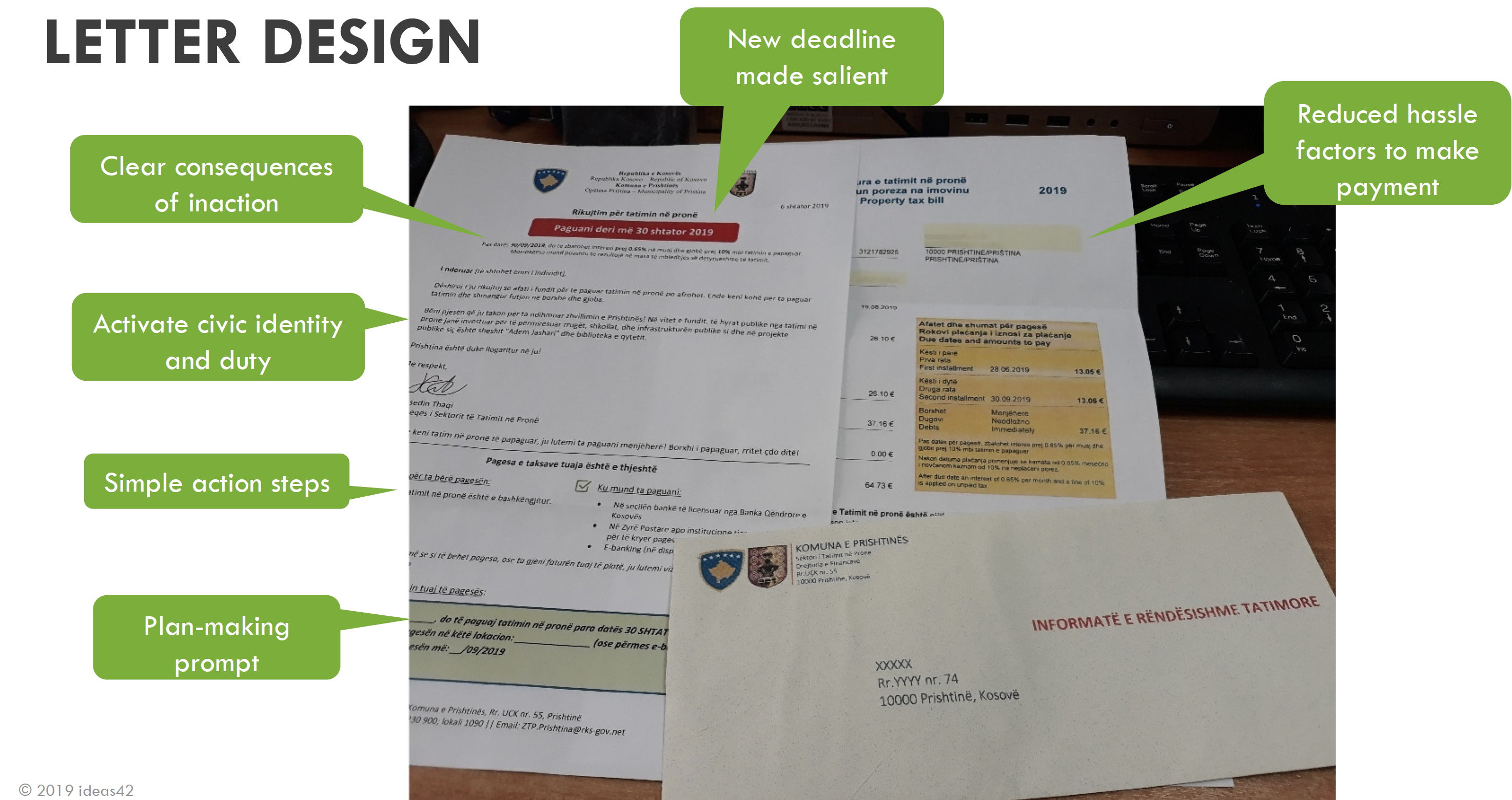

A behaviorally designed letter reminding to pay property taxes was sent to tax-owing citizens of Pristina, Kosovo. The letter made the deadline and consequences of inaction salient, listed concrete action steps, prompted a plan, activated civic identity, and included the first page of the bill required for payment.

Impact

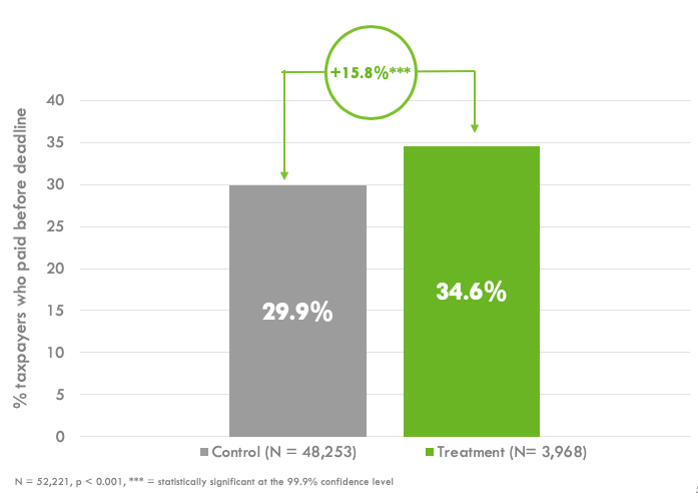

On-time property tax payment rates increased by 4.7 percentage points, from 29.8% to 34.6%.

Challenge

Kosovo is the youngest country in Europe and faces the challenges of creating a government and setting up systems to generate funds needed to invest and develop. In 2018, only 47% of taxpayers made even a partial payment towards their due taxes. The consequences of low tax compliance and late repayment are two-fold. Individuals accumulate debt, interest, and fines from nonpayment which also prevents them from purchasing homes or registering vehicles until these debts are paid. On the city side, it is challenging to plan the annual budget and make necessary investments in infrastructure and public services.

Design

In partnership with the OSCE Mission in Kosovo and Municipality of Pristina, we sent a behaviorally designed courtesy letter along with a copy of the first page of the property tax bill (required for payment) to prompt individuals to pay their tax liabilities in a timely manner. The letter leverages psychological concepts and well-studied design elements such as removing the hassle of finding or printing the tax bill required for payment, increasing the salience of the deadline and consequences of inaction, priming civic duty and identity (e.g. “Your support enables Pristina to continue funding the public projects necessary for our development and growth. Our city is counting on you!)”, prompting planning for the date and method of payment, and simplifying language and instructions (i.e. what you need and where you can make the payment).

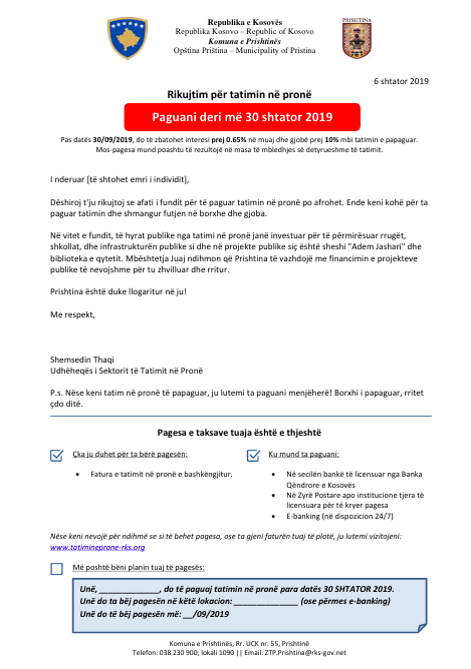

New reminder letter, in Albanian

Out of 52,652 taxpayers who at the time of the intervention still owed some property taxes for 2019, 4,000 were randomly selected to be sent the new reminder letter (treatment group), while the others (control group) received no letter/communication (“business-as-usual”). The deadline for tax payment was September 30th, and the letters were delivered in a ten-day window (September 14-24th). The city employed a courier service that tracked delivery status and requested a receipt confirmation signature from the recipients. After three unsuccessful delivery attempts, the letter was left in the mailbox/ at the doorstep.

Impact

The randomized evaluation found that property owners in the treatment group had a 15.8% higher rate of making any on-time payment than those who were not (34.58% vs. 29.85%), a statistically significant difference (p < 0.001). Additionally, the intervention had a positive impact on those who were previously delinquent - and who historically are the least likely group to pay on time. Among citizens who did not pay their property taxes at all in the previous year, those in the treatment group had a 59.2% higher rate of on-time payment (11.2 % vs. 6.9%, p <0.001).

Notably, these impacts were achieved despite the fact that a large proportion of the treatment group did not actually receive the intervention letter due to incorrect or incomplete addresses, or other reasons. Incorrect taxpayer addresses were a significant hurdle to delivery of the intervention, and reliability of the delivery status data was also a challenge for analysis.

Implementation Guidelines

Inspired to implement this design in your own work? Here are some things to think about before you get started:

- Are the behavioral drivers to the problem you are trying to solve similar to the ones described in the challenge section of this project?

- Is it feasible to adapt the design to address your problem?

- Could there be structural barriers at play that might keep the design from having the desired effect?

- Finally, we encourage you to make sure you monitor, test and take steps to iterate on designs often when either adapting them to a new context or scaling up to make sure they’re effective.

Additionally, consider the following insights from the design’s researcher:

- Evaluate the reliability of the municipality address database. It impacts not only the rate at which citizens receive initial tax notification letters but also the impact potential of any mail interventions.

- Anticipate the costs and other logistical difficulties of letter delivery – e.g. printing, postage (2 euros each in Kosovo), customizing letters, etc.

- Consider the timing of the letters. If sent too early (e.g. several months before the deadline) some people would have paid on time anyway, but if sent too late, people do not have time to react and plan to make the payment before the deadline.

- Compare the costs and potential benefits of alternative communication delivery channels. It may be worth testing if the additional impact is commensurate with the cost of the chosen channel. For example, SMS or automated calls are inexpensive. However, their impact may be smaller than that of letters. This is especially true in situations where mobile phone usage is low or phone numbers are not regularly collected and updated by the municipality. Mail courier services differ in terms of costs and potential for impact. More expensive ones can provide valuable information on delivery rates and non-delivery reasons. Moreover, hand-delivered or delivery-confirmation letters might influence the recipient’s perception of the communication and therefore increase their response to it.

- Consider a staggered approach where simpler, cheaper interventions are deployed first. Following initial testing, explore targeting more expensive interventions for groups where these can achieve the highest impact.

Project Credits

Researchers:

Cecilia Shang ideas42

Laura Cojocaru ideas42

Huma Khan ideas42

Josh Martin ideas42

Saugato Datta ideas42