Relationship Managers Improve Loan Repayment

Organization : Innovations for Poverty Action

Project Overview

Project Summary

ICICI Bank’s relationship managers regularly called small business borrowers to establish trust with the client, remind them of any upcoming payment deadlines, and address any other issues that their clients might be facing.

Impact

Clients with a personal relationship manager had lower delinquency rates and fewer delinquent periods compared to clients who were only contacted when they had missed a payment.

Cost

It cost $300 per month to pay six relationship managers.

Source

Source

Challenge

Businesses in developing countries grow less than in developed countries due to such financial constraints as limited loan access. Because financial information for small business borrowers is difficult to obtain and verify, banks are often unable to assess the credit risk of these borrowers. Banks that do lend to small, private firms often encounter high default and late payment rates from those clients.

Small and medium enterprises are the biggest contributor to employment across countries, providing over 66% of jobs on average. As a result, banks and policymakers are interested in low-cost ways to reduce default rates and late payments on loans to small businesses.

Design

ICICI bank, India’s largest commercial bank, implemented a new personalized banking program among their portfolio of small business borrowers. For approximately two years, ICICI’s relationship managers called borrowers every other week in order to establish trust with the client and check to see if the client had any issues with the loan (for example, if monthly statements had not been received or if checks had not been deposited). If the client missed a payment deadline, the relationship manager would also remind the borrower to pay on time to avoid late fees.

Impact

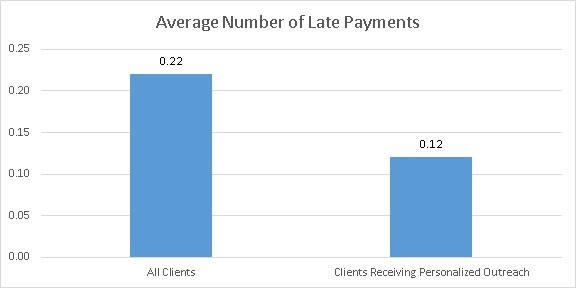

A randomized evaluation assessed the impact of personalized attention on borrowers’ loan repayment performance. Borrowers who received calls from relationship managers had approximately 0.1 fewer instances of being late on a payment, relative to borrowers who did not receive personalized attention from the bank. Given that the average number of late instances among all borrowers was 0.22, this reduction was very meaningful to the bank.

Among clients who were late on a payment, borrowers who received personal attention were between 21.7 and 24.5 percentage points less likely to pay late more than once. On average, 31.2% of clients with a late payment were late on more than one occasion, so the reduction in delinquency was once again financially significant for the bank.

What worked best

- Assigning clients dedicated relationship managers, rather than rotating client calls among a team of relationship managers. Dedicated managers delayed borrowers’ first delinquent period and decreased the overall time that accounts were overdrawn. Being contacted by multiple relationship managers did not affect these two outcomes.

Note that this “higher touch” service had some potential drawbacks for the bank. Although borrowers with dedicated relationship managers were less likely to have complained about the banks’ service, those who did logged more complaints than borrowers with multiple managers, and they were less likely to have their complaints resolved. There was no evidence that borrowers with dedicated relationship managers were more satisfied with their loans overall.

Implementation Guidelines

Inspired to implement this design in your own work? Here are some things to think about before you get started:

- Are the behavioral drivers to the problem you are trying to solve similar to the ones described in the challenge section of this project?

- Is it feasible to adapt the design to address your problem?

- Could there be structural barriers at play that might keep the design from having the desired effect?

- Finally, we encourage you to make sure you monitor, test and take steps to iterate on designs often when either adapting them to a new context or scaling up to make sure they’re effective.

Additionally, consider the following insights from the design’s researcher:

- Outreach to clients and any computer systems that support the relationship managers should run smoothly. In the study described, relationship managers entered the details of their conversation with the client into the system, so that in future conversations the relationship manager could easily recall the issues that had been discussed previously.

Would this work elsewhere?

Other studies in the United States, Bangladesh, and China (among other places) have demonstrated that relationship banking can help banks learn about clients’ competence, the quality of their businesses, or even their personal integrity.[1] However, this is the first study that has demonstrated that banks can also use relationship banking to reduce loan defaults. Researchers believe that these results may be generalizable to other contexts where the same conditions apply:

- Where bank representatives do not have a pre-existing personal relationship with account holders;

- Where the bank has sufficient resources to provide higher-touch client service and support;

- Where banks are working with small businesses qualified to receive medium-sized loans (the average loan in this context was $20,611; see below for an overview of the credit approval process that ICICI used);

Cost effectiveness

The program was quite effective for the bank; relationship banking cut the number of periods in which clients were late on payments almost in half. Although training and hiring personnel can be costly, ICICI was able to use five or six relationship managers at a time to cover 1,319 clients. They paid each relationship manager approximately 3000 rupees per month. ICICI was able to provide oversight for the relationship managers as part of their existing call center. Costs you are likely to encounter include:

- Training and/or hiring account relationship managers

- Additional personnel time for handling customer requests and complaints that emerge during relationship banking phone calls

Tips on hiring and training relationship managers:

To implement the call outreach, the bank initially hired and trained three relationship managers in collaboration with the bank, with an additional three managers hired during the course of the study. They selected relationship managers for their problem-solving skills, language proficiency in Hindi and English, general communication skills and ability to build trust over the phone. The callers were stationed at the bank’s main call center in Mumbai under the joint supervision of a study research associate and the ICICI customer service team responsible for the loan products.

The managers were trained in line with ICICI’s protocols to handle typical customer service issues. In addition, managers were provided basic scripts for customer service calls and trained to log all study calls in a standardized way, including whether clients were reached, client responses when prompted about repayment, and any issues the client was facing. Typical client concerns included failing to receive monthly account statements (or other services they had signed up for), and requesting information about the status of account transactions or bank fee policies. When an issue arose that the relationship managers could not handle directly, they explained the process to forward the complaint to a higher level.

Details on the loan product and procedures:

ICICI bank introduced a collateral-free small business loan product in 2005, which was intended for working capital or ad hoc investment purposes. The loan is set up as an overdraft facility with a predetermined limit, which functions like a de facto credit card account. The target group of borrowers included small manufacturers, trading companies and service providers, which, in 2005, constituted a relatively new set of clients for the bank.

The process of loan origination is done by loan officers who meet clients at the branches and provide an initial review of the eligibility criteria, collect documentation and forward the application files to a central credit processing agency (“CPA”). The credit appraisal is based on the characteristics of the business such as business type and hard information such as bank statements, references, credit reports, and financial information based on unaudited financial statements or income tax returns.

The small business loan product has two separate variants: Smart Business Loan product (SBL) and SBL Power (Power). The SBL Power loan is differentiated from the standard SBL product in that it has a quicker approval time but on average has smaller loan sizes, at $10,937 compared to the standard SBL average of $24,523. Overdraft amounts for SBL overall range from $5,515 to $55,1505 for businesses with annual sales from $88,240 to $3,308,994. All other features are the same between SBL and SBL Power. Each month a borrower must pay an amount equal to 5% of their total outstanding balance including interest charges. Interest rates depend on the loan size and a fixed premium above an internal benchmark rate and are fixed at the time the loan is sanctioned but may be revised on renewal. All overdraft limits are sanctioned for a period of 12 months. Penalty interest rates and late fees are not used, though past due accounts may be contacted by collections staff and have their non-performance reported to credit agencies.

In the eleventh month after sanctioning the loan, the bank reviews account performance and decides whether to renew the loan for an additional year and whether to adjust to the overdraft limit.

Project Credits

Researchers:

Antoinette Schoar Contact MIT Sloan School of Management; National Bureau of Economic Research (NBER)

[1] See, for example, Petersen, Mitchell A. and Raghuram G. Rajan. 1995. The Effect of Credit Market Competition on Lending Relationships. Quarterly Journal of Economics. 110(2), 407-443; Berger, Allen N. and Gregory F. Udell. 1995. “Relationship lending and lines of credit in small firm finance.” Journal of Business 68: 351-382; Cole, Rebel A., 1998. “The importance of relationships to the availability of credit,” Journal of Banking & Finance, Elsevier, vol. 22(6-8), pages 959-977, August; Chang, Chun, Liao, Guanmin, Yu Xiaoyn and Ni, Zheng, 2010. “Information from Relationship Lending: Evidence from Loan Defaults on China. European Banking Center Discussion Paper No.2009-01; Chakravarty, Sugato & Abu Zafar Shahriar, 2010. “Relationship Lending in Microcredit: Evidence from Bangladesh,” Working Papers 1004, Purdue University, Department of Consumer Sciences.