Text Nudges to Build Resilience through Cash Transfers

Organization : ideas42

Project Overview

Project Summary

Recipients of a COVID-19 relief cash transfer in Kinshasa, DRC were sent goal-setting and plan-making SMS nudges to identify and spend their cash on priorities to build resilience.

Impact

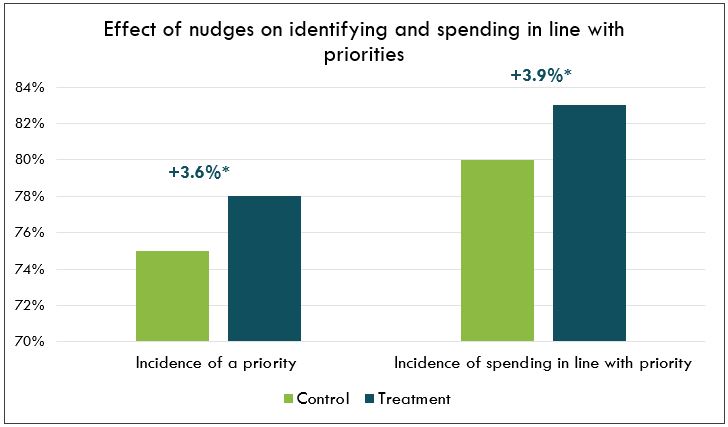

Receipt of the SMS nudges increased the incidence of having a priority by 2.7 percentage points and increased the incidence of spending toward that priority by 3 percentage points compared to those who did not receive the nudge.

Cost

USD $0.22 per person

Challenge

As cash transfer programs have expanded during the COVID-19 pandemic, it has become crucial that governments and organizations with limited resources support affected recipients to spend their cash effectively to prepare for their future and be more resilient to economic shocks. In the DRC, the World Bank and the Fonds Social du Republique Democratique du Congo (FSRDC) are implementing a cash transfer program to support citizens in urban Kinshasa, many of whom are likely to work in the informal or vulnerable employment sectors most effected by the pandemic and associated lockdowns. The temporary transfer provides recipients with 25 USD per month via mobile money over a period of 6 months.

Recipients of cash transfers often experience cognitive scarcity due to the hardships they face, which limits their mental bandwidth available to make complex budgeting and spending decisions. Without a clear moment of choice to determine how to spend their cash, most recipients don’t plan in advance, and a lack of planning tools leads to difficulty allocating cash to cover all priorities. Furthermore, an identity of poverty may lead to feelings of disempowerment or a stagnation mindset, discouraging concrete planning for improving their lives. For this population living in poverty, with scarce resources, and during a global pandemic, leveraging an influx of cash to build resilience and improve future prospects can be particularly difficult without support or scaffolding.

Design

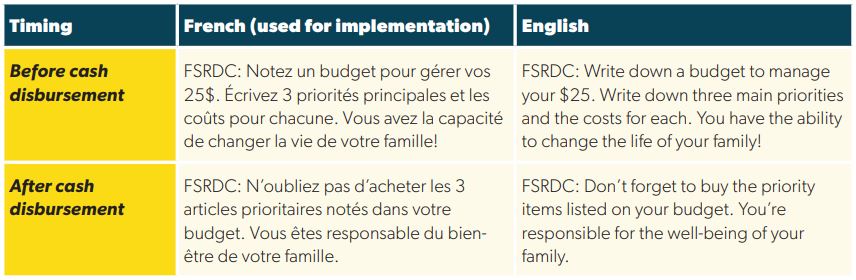

SMS nudges were developed to address the barriers recipients faced in spending their money on their priorities, with the ultimate goal of building economic resilience. Participants received a text message one day before they received their transfer, in which they were prompted to consider their priorities for spending the cash transfer and were provided with simple instructions to consider or write down a plan for budgeting. One day after the cash was available, participants were sent an SMS reminder that encouraged them to follow through with spending according to their budget. Both messages also emphasized the recipient’s agency and ability (example messages can be found in Table 1). Both messages were sent in the evenings on weekdays (at about 5pm), as this was identified as a time participants were most likely to have their phone, for it to be charged, and to have an opportunity to focus on their messages.

Half of a wave of 30,000 cash transfer recipients were randomly selected to receive the SMS nudges during one payment cycle and half did not. One month after the transfer, recipients were sent an interactive voice response (IVR) survey to measure outcomes.

Impact

A randomized evaluation found that the SMS nudges led to a 2.7 percentage point increase in the incidence of having an identified priority for spending the transfer, from 75% to 78%, and a 3 percentage point increase in recipients reporting spending in line with their priority, from 80% to 83%, when compared to those who did not receive the SMS nudges.

In addition, those who received the SMS nudges and completed the IVR survey were also 3.2 percentage points more likely to report having a future-oriented priority (including education, savings, debt repayment, or investing in an income-generating activity), from 47% to 50%, than those who did not receive the SMS nudges.

Implementation Guidelines

Inspired to implement this design in your own work? Here are some things to think about before you get started:

- Are the behavioral drivers to the problem you are trying to solve similar to the ones described in the challenge section of this project?

- Is it feasible to adapt the design to address your problem?

- Could there be structural barriers at play that might keep the design from having the desired effect?

- Finally, we encourage you to make sure you monitor, test and take steps to iterate on designs often when either adapting them to a new context or scaling up to make sure they’re effective.

Additionally, consider the following insights from the design’s researchers:

- Given that many cash transfer programs already plan to send SMSs to recipients, such as messages about when they can obtain their cash, implementers should build planning and budgeting nudges into programs from inception. During this trial, SMSs were sent before and after one disbursement in the middle of the payment period due to project constraints but it is recommended that these messages be sent with every payment during future implementation.

- Wherever possible, implementers should also work with local Telcos to send SMSs in bulk, which can significantly reduce costs, making such nudges incredibly cost-effective.

- Based on calculations from this study, the cost was $0.22 USD per person (higher than it would be if sent through local Telcos). Even at this cost, the nudges were extremely cost-effective: achieving the same effect of additional money spent on priorities without the nudges would have required providing 8 times the cost of the SMS in additional cash to recipients.

Project Credits

Researchers:

Saugato Datta ideas42

Bradley Noble ideas42

Kate MacLeod ideas42